Within this site, you will find general information about the District and the ad valorem property tax system in Texas, as well as information regarding specific properties within the district.

Walker County Appraisal District is responsible for appraising all real and business personal property within Walker County. The district appraises property according to the Texas Property Tax Code and the Uniform Standards of Professional Appraisal Practices (USPAP).

Property taxes are local taxes. Local officials value your property, set your tax rates, and collect your taxes. State law governs how this process works.

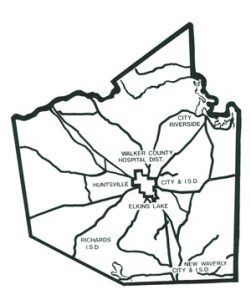

There are four main parts to the property tax system. The appraisal district values property, administers exemptions, and maintains current ownership information on the appraisal records. The appraisal review board is a panel made up of people from the local community; they are independent of the appraisal district. They settle any disagreements between the appraisal district and the property owner about the valuation of the property. The governing bodies of the taxing units, such as the city councils, school boards, or county commissioners decide the annual budgets and set the tax rates. This determines the total amount of taxes to be paid. In Walker County, the appraisal district calculates the levy, mails the statements, collects the taxes, and distributes the tax revenue to the taxing units.